Full article here on SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4250812

Introduction

Risk parity is a powerful portfolio construction approach that achieves diversification in terms of asset risk exposures. It masterfully utilizes information on volatilities and correlations to balance a portfolio such that each asset in the portfolio contributes equally to total portfolio risk. This article seeks to explain the benefits of risk parity as an approach to portfolio construction, as well as outline the theoretical foundations of this approach in as clearer manner as possible. For reader clarity, both summation notation and matrix notation are used. This article has been written in response to the author’s own challenges with finding a clear, holistic overview of the risk parity approach and its derivation.

Characteristics

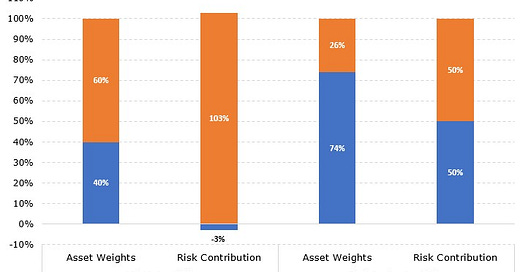

Most investment portfolios are not as diversified as they claim. For example, the ubiquitous 60/40 stocks/bonds portfolio typically has 90%+ of its risk in stocks despite stocks only having a 60% weighting (see Figure 1). Risk parity overcomes this imbalanced risk problem. It is a particularly useful approach for longer-term asset allocating investors and investors that are humble enough to admit that returns are difficult to predict. Why? Because true risk parity only incorporates volatility and correlation information and omits any forecast as to expected asset returns. As an approach, it acknowledges that the former is much easier to estimate than the latter. As this last point makes clear (and the name indicates), risk parity is therefore a form of risk management for longer-term investors content to receive whatever longer-term returns the market may provide while managing the risk of those returns.

Figure 1 – Using the SPY ETF (S&P500 Index) total returns to proxy stock returns and the IEF ETF (7-10yr US Treasury Bonds) total returns to proxy bond returns from a data sample from 2003-2022, we obtain the above risk decomposition. This shows us that in a standard 60/40 portfolio, despite only 60% of cash being allocated to stocks, 103% of the risk emanates from stocks. Bonds have a risk mitigating effect in this portfolio, dampening overall risk by 3%. In contrast, a risk parity approach achieves an equal contribution from stocks and bonds to total risk with an allocation of 74% to bonds and 26% to stocks.

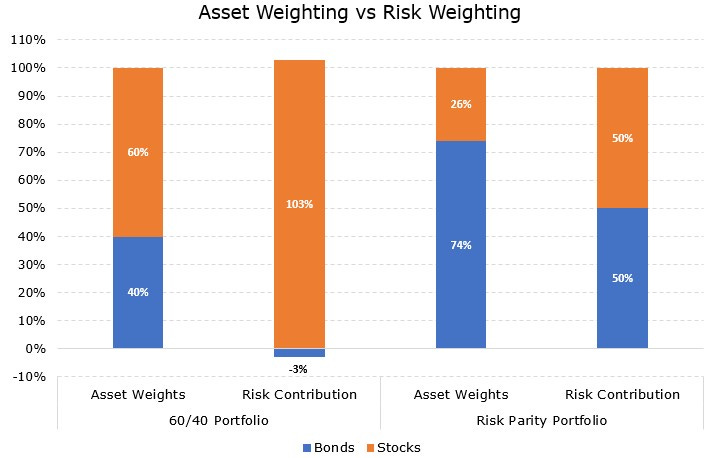

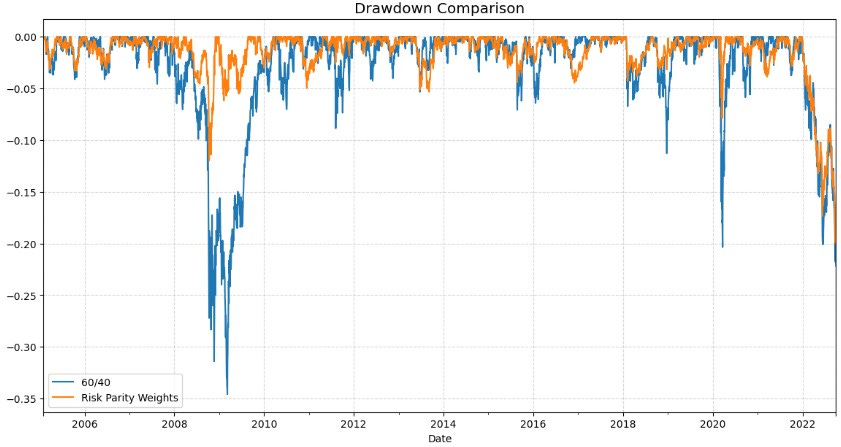

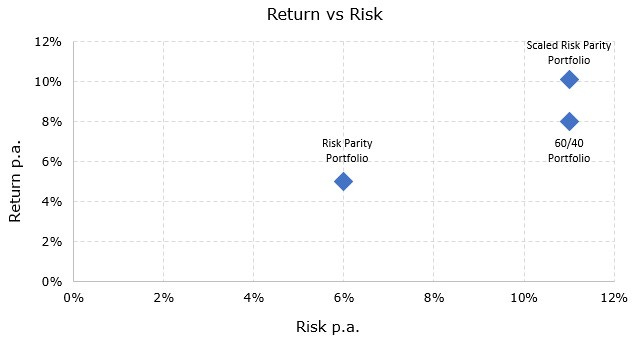

While risk parity has been around since the early 1990s, it came to prominence after the 2008 Global Financial Crisis, having proven its worth as a risk diversification tool. In particular, the spotlight moved to risk parity at this time due to the marked outperformance – absolute and risk-adjusted – of risk parity portfolios compared to standard 60/40 portfolios, where investors believed they were diversified until they suffered tremendous drawdown and investment losses (see Figure 2). The main benefit of risk parity comes in the form of increased portfolio diversification, which on average lowers overall portfolio risk relative to portfolio return, and hence improves risk-adjusted returns (see Figure 3). On average, assets with a high correlation to other assets, or assets with a high level of volatility, tend to receive a lower weight in risk parity portfolios. Another related benefit is derived from the dynamic rebalancing of the portfolio at regular intervals to the target risk parity weights, which allows the portfolio to adapt to changing risk conditions in the market – something the standard 60/40 portfolio does not (apart from infrequently rebalancing, typically at most quarterly, to maintain the target 60/40 allocation to stocks/bonds).

Figure 2 – Again, using the SPY ETF (S&P500 Index) total returns to proxy stock returns and the IEF ETF (7-10yr US Treasury Bonds) total returns to proxy bond returns from a data sample from 2003-2022, we obtain the above drawdown profiles for a 60/40 portfolio and a risk parity portfolio. The maximum drawdown of the 60/40 portfolio is close to -35% while fore the risk parity portfolio it is close to -20%.

Figure 3 – Using the SPY ETF (S&P500 Index) total returns to proxy stock returns and the IEF ETF (7-10yr US Treasury Bonds) total returns to proxy bond returns from a data sample from 2003-2022, we obtain the above return vs risk profiles for a 60/40 portfolio and a risk parity portfolio. The unscaled risk parity portfolio yields a better return/risk ratio (0.92) compared to the 60/40 portfolio (0.73). Given these ratios, as the risk parity portfolio generates lower risk than the 60/40 portfolio, it does also generate a lower return. However, one can scale the risk parity portfolio to generate a similar level of risk (11%) to the 60/40 portfolio, which generates a superior return of 10% compared to the 60/40 portfolio’s return of 8%.

Although risk parity is a general approach used to balance risk across assets, its application can be much broader. It can be used to balance risk across e.g., ‘factors’ (return streams that themselves are made up of linear combinations of assets) or to balance risk across signals in a portfolio if one does not have enough information to discern if some signals are better than others. Another common practice is applying risk parity to manage ‘risk premia’. Regardless of its application, it is a useful approach to balance portfolio risk across assets, signals, factors or premia.

Derivation

The derivation of the risk parity approach is an interesting exercise. To begin, we must define what we mean with ‘risk.’ In our context, we will use the covariance matrix as our measure of risk. The covariance matrix measures volatility in the form of standard deviations (e.g., how much an asset’s return varies about its mean over a given time horizon).[1] It also measures covariances (e.g., how much assets co-vary together), which can be converted to correlations with simple algebra. In the following derivation, we will use standard summation notation but also supplement this with matrix notation given computers are typically needed to compute risk parity portfolios and data is often stored as matrices and vectors in computers.

Full derivation here on SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4250812

[1] Measures of risk other than standard deviation can also be used, e.g., Value-at-Risk. It is also worth pointing out the usual caveat that returns are not normally distributed and typically have fat tails.

I like the way your thinking is heading. I usually assume that during periods of crisis, the correlations move closer to +1.0 or -1.0. So, I make the assumption that current risk is likely understated in normal conditions and try to balance the portfolio, capping risk across all the positions at a comfort level that I can live with. When crisis strikes, correlations increase, everything seems to panic at once and you’ve already planned for it.